Boost AOV and Conversion Rate With Buy Now, Pay Later

Published On

May 24, 2023

Updated On

Dec 11, 2024

Brian Moran

Founder

Samara Lemon

VP of Marketing

Leilani Treuting

Marketing Director

Scott Moran

Co-Founder

If you're selling digital products online, you need more than a pretty way to deliver your content. You need an easy way to boost conversions, maximize customer value, and run your business without worrying about technology.

Table of Contents

Share this article

Being an online creator and trying to sell products, goods, and services in a challenging economy can be confusing and, oftentimes, disheartening.

Pricing in any economy is everything: how are you positioning yourself and your offerings? If it’s too cheap, your customers won’t take what you’re selling seriously. Too expensive, and you alienate a large chunk of your target audience.

But times are different now – creators are having to think about ways to keep prices steady or raise them strategically while converting more customers while remaining sensitive to consumer spending behaviors.

We cover all of these topics and how services like Buy Now, Pay Later can address many of these issues in The BNPL Solution: Boost Your Order Values and

Conversions in a Challenging Economy – Without the Risk of Payment Plans, the newest white paper from the SamCart team. We’ll cover some of the highlights in this article, but you can download the white paper for yourself to really dig into the wealth of insights, information, and advice.

eCommerce and economic recession

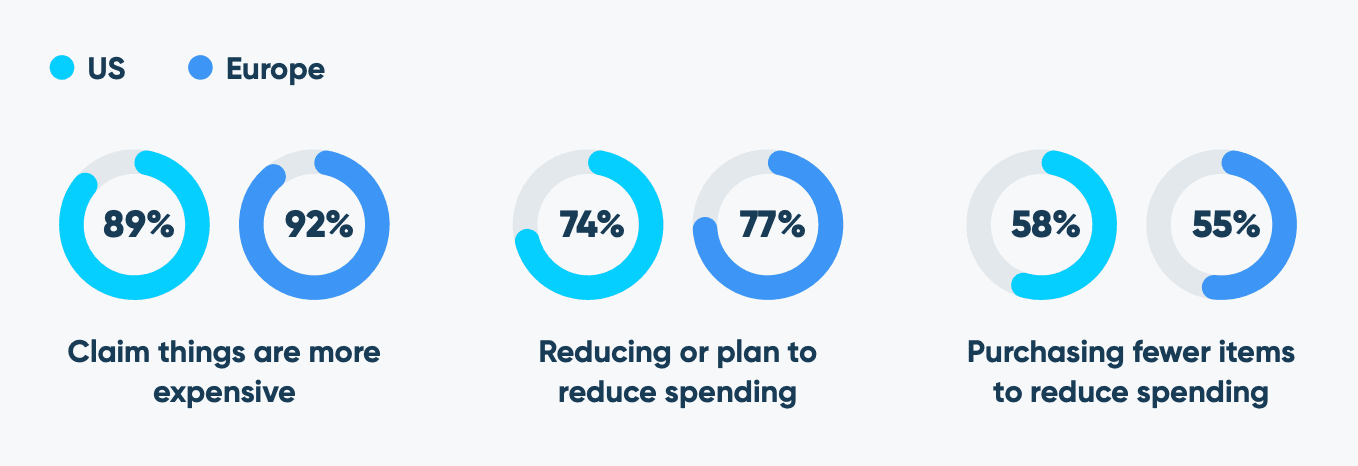

We aren’t technically in a recession at this moment, but 65% of economists polled by Bloomberg expect the US to fall into a recession this year. Already, due to spiking inflation and interest rates, consumers are significantly curbing spending. Unfortunately for many of us online creators, most of the goods, services, and products we sell fall into the “non-essential” category.

This leaves online creators puzzled: How should we be pricing our offerings to reflect consumer behavior that doesn’t pinch our profit margins?

It’s likely that your high-ticket products will take the biggest hit during times of economic uncertainty because they’re the first thing to scare potential customers away.

On SamCart, 55% of all revenue processed through our platform comes from only 5% of transactions – those being from high-ticket items priced $499 and above a pop. These large transactions create a ton of friction, but they also create the biggest opportunities to generate profitable sales.

So how do we make it easier for customers to buy high-ticket offers during recession or other periods of economic downturn? Do we:

Cut prices to boost conversions?

Make bigger, bolder claims in your marketing messaging?

Change the payment terms to lower the initial cost?

Let’s double-click on that third option and how you can offer customers a frictionless way to lighten the initial price load in a way that doesn’t leave you to eat the unpaid cost (as traditional payment plans often do).

The Buy Now, Pay Later phenomenon

Buy Now, Pay Later (or BNPL) is a payment option that allows customers to split the total cost of their order into smaller, interest-free payments over time. Companies like Klarna, Afterpay, and Affirm offer these services and assume the risks like underwriting and collections from those who don’t complete their payment plan.

BNPL is simple to install from the merchant’s end, and even easier to use from the customer’s end so long as it is built into the checkout flow. Between 2019 and 2021, BNPL transactions soared from $33B to $120B. That number is expected to hit $570B by 2026.

But why? What makes it so remarkable?

For sellers:

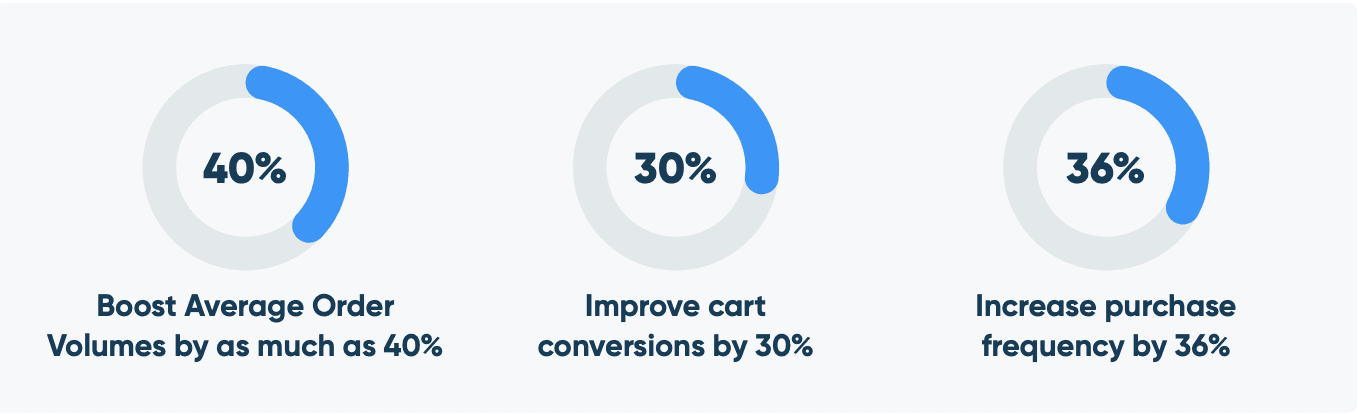

It can increase average order value by as much as 40%

It can improve cart conversions by 30%

It can increase purchase frequency by 36%

…all because customers have the perception that those high-ticket purchases they’re making are more affordable. These payments also happen on a biweekly or monthly basis, which falls in line with many customers’ pay days.

For customers:

It makes high-ticket purchases seemingly more affordable

It allows you to get the immediate value out of your purchase without having to pay the full cost upfront

BNPL is now available to creators on SamCart.

BNPL and SamCart

The SamCart team received a lot of requests to partner with BNPL providers, so we launched a beta test that uncovered the specific benefits of BNPL for digital creators.

In sifting through the data, we hypothesized that buyers of digital products might be over 200% more willing to use BNPL for their purchases.

Now, BNPL is available to SamCart customers who use SamPay as their payment processor, with three distinct benefits for utilizing these services:

You (the creator) get paid in full immediately, reducing the risk of customers reneging on their payment plan fulfillment

Your customers are likely to spend more, given the illusion of affordability

BNPL works for your least expensive to your most expensive products

Whether you’re a seller whose offerings you can’t find anywhere else, or you play in a space where you want a competitive advantage, consumer behavior dictates that having BNPL as a payment option at checkout can put you miles ahead of your competition.

Download The BNPL Solution and start your free SamCart trial

Learn more about how eCommerce creators are navigating this economic uncertainty and using BNPL to arm themselves with the most opportunity possible. Then, when you’re ready to put these learnings into action, start a 7-day trial to give BNPL and SamCart a whirl.

SamCart Editorial Team

Brian Moran

Founder

Samara Lemon

VP of Marketing

Leilani Treuting

Marketing Director

Scott Moran

Co-Founder